The Y Range (I4:I25) includes the data you want to predict (computer per capita sales), including the column label.

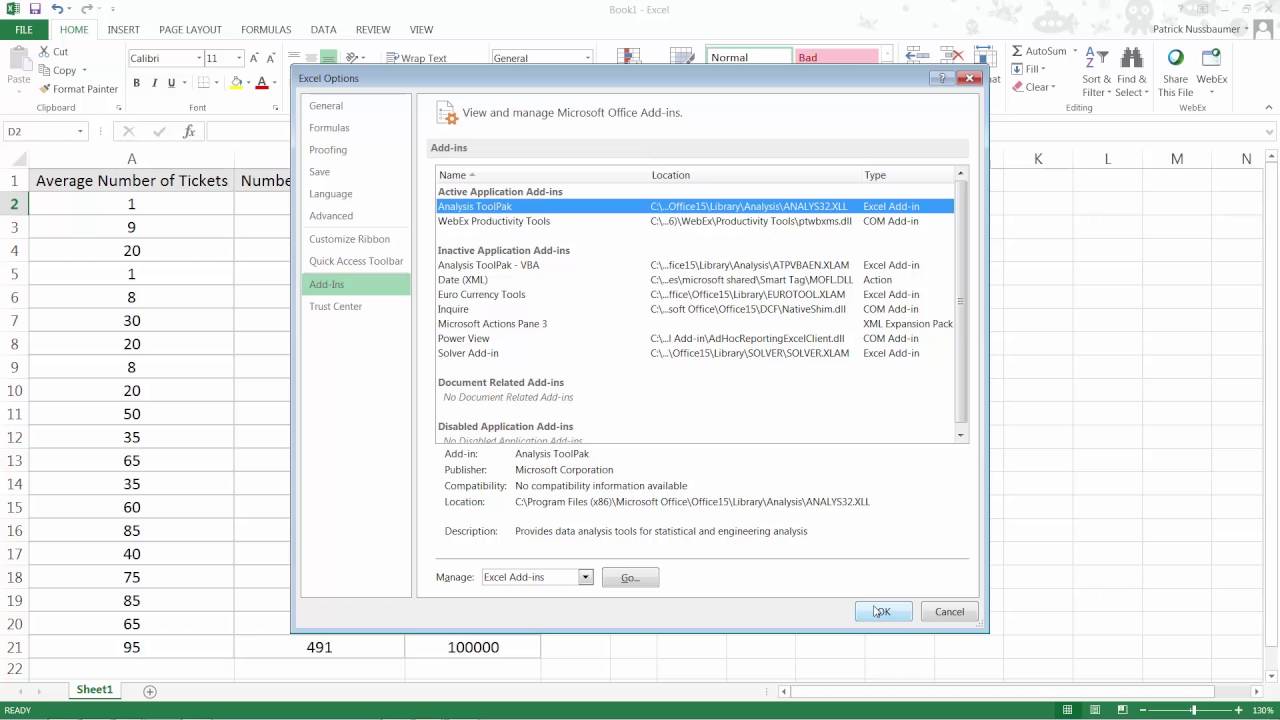

When the Regression dialog box appears, fill it in, as shown in Figure 10.2. To run a regression, select Data Analysis in the Analysis Group on the Data tab, and then select Regression.

See Chapter 9 for a refresher on installation instructions for the Data Analysis Add-In. You can use the Excel Data Analysis Add-In to determine the best-fitting multiple linear regression equation to a given set of data. Running a Regression with the Data Analysis Add-In In order to apply the multiple linear regression model to the example, Y = Per Capital Computer spending, n = 3, X 1 = Per Capita GNP, X 2 = Unemployment Rate, and X 3 = Percentage of GNP spent on education.

MULTILINEAR REGRESSION EXCEL SERIES

In time series data, the same dependent variable is measured at different times. This data is cross-sectional data because the same dependent variable is measured in different locations at the same point in time.

From the 2011 Pocket World in Figures by The Economist, you can obtain the following data from 2007 (as shown in Figure 10.1 and file Europe.xlsx) for European countries: To set fair quotas, HAL needs a way to accurately forecast computer sales in each person's territory. HAL sets sales quotas for all salespeople based on their territory.

MULTILINEAR REGRESSION EXCEL HOW TO

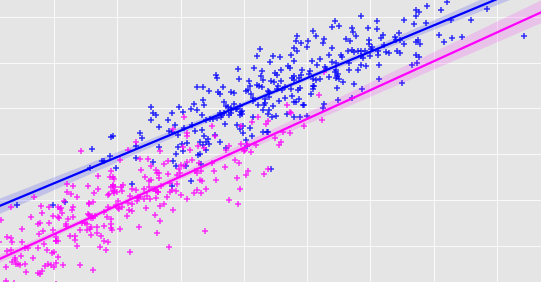

To best illustrate how to use multiple regression, the remainder of the chapter presents examples of its use based on a fictional computer sales company, HAL Computer. In the “Testing Validity of Multiple Regression Assumptions,” section of this chapter you will learn how to determine if the assumptions of regression analysis are satisfied, and what to do if the assumptions are not satisfied. This means, for example, that if for one observation the error term is a large positive number, then this tells you nothing about the value of successive error terms.

In this chapter the dependent variable Y usually equals the sales of a product during a given time period.ĭue to its simplicity, univariate regression (as discussed in Chapter 9, “Simple Linear Regression and Correlation”) may not explain all or even most of the variance in Y. In causal forecasting, you try and predict a dependent variable (usually called Y) from one or more independent variables (usually referred to as X 1, X 2, …, X n). This chapter continues the discussion of causal forecasting as it pertains to this need. Using Multiple Regression to Forecast SalesĪ common need in marketing analytics is forecasting the sales of a product. Marketing Analytics: Data-Driven Techniques with Microsoft Excel (2014) Part III.

0 kommentar(er)

0 kommentar(er)